Let’s be honest-paying for prescriptions shouldn’t feel like a gamble. You get a script from your doctor, walk into the pharmacy, and suddenly you’re staring at a price tag that could cover your rent for a week. That’s where prescription discount programs and coupons come in. They promise big savings. But do they actually work? Or are they just another confusing piece of the broken healthcare puzzle?

How These Programs Actually Work

There are three main types of prescription discount tools out there: manufacturer coupons, third-party discount cards like GoodRx, and prescription assistance programs (PAPs). Each one plays by different rules.Manufacturer coupons are handed out by drug companies-usually for brand-name medications. You sign up on their website, print or download a coupon, and show it at the pharmacy. It cuts your copay, but here’s the catch: it doesn’t lower the drug’s list price. The pharmacy still charges the full amount, and your insurance (if you have it) might not even let you use the coupon at all. In fact, Medicare Part D plans often block these coupons entirely unless you get special approval.

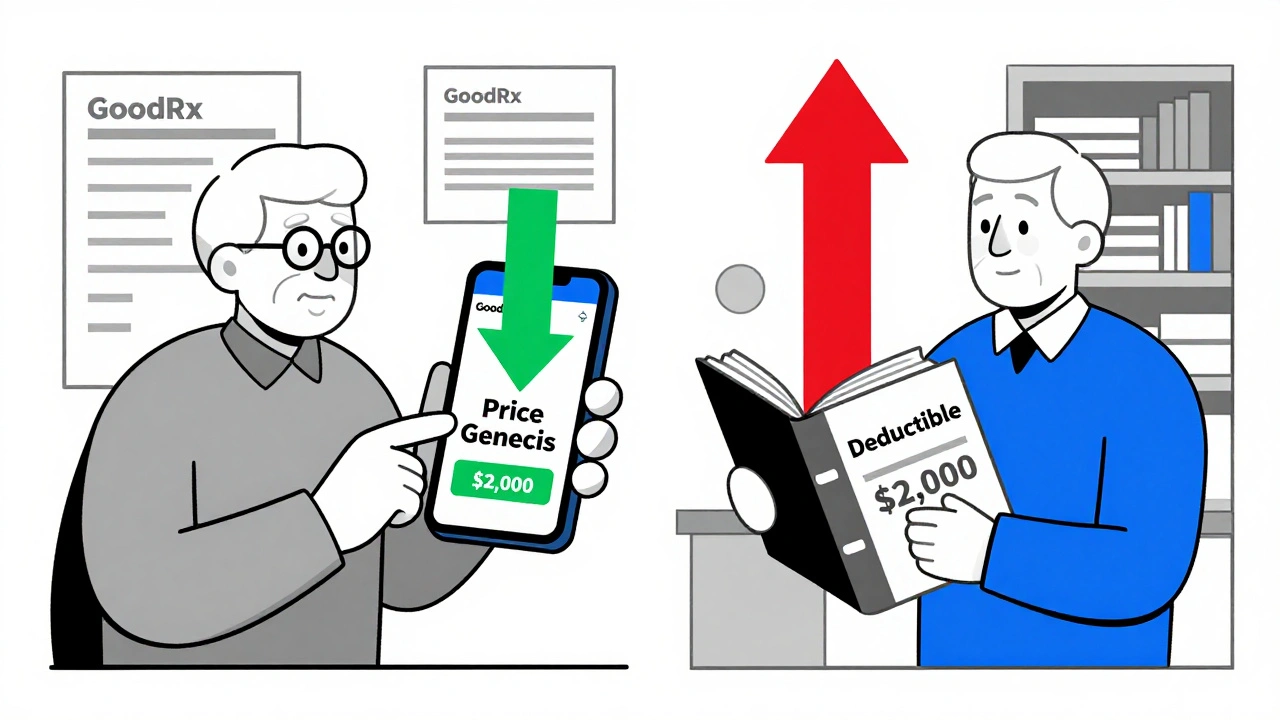

Third-party discount cards like GoodRx, Blink Health, and SingleCare work differently. They don’t deal with your insurance. Instead, they negotiate cash prices directly with pharmacies. Think of them as a secret wholesale deal you can access for free. You enter your drug name and zip code on their app or website, and it shows you which nearby pharmacy has the lowest cash price. No insurance needed. No registration. Just show the barcode at the counter.

Prescription assistance programs are the most straightforward-if you qualify. These are run by nonprofits, clinics, or drug manufacturers for people with no insurance or very low income. You apply, prove your financial need, and if approved, you get the medication for free or at a tiny cost. No coupons, no cards. Just medication in your hands.

Where the Real Savings Happen

The big question: how much do these programs actually save you? The answer depends on what drug you’re taking.For generic medications, third-party discount cards are a game-changer. A 2022 study found that GoodRx brought down the cash price of a common 3-drug generic heart regimen from $52.80 to just $18.60. That’s a 65% drop. For metformin, users on Reddit reported saving $47.83 on a 90-day supply compared to their insurance copay. In some cases, the discount card price is lower than your insurance’s negotiated rate.

But brand-name drugs? Not so much. The same study showed that for a 4-drug heart failure regimen made up mostly of brand-name pills, GoodRx only saved users $88.04-less than 10%. The drug’s list price was over $1,300. Even with a coupon, you’re still paying over $1,200. That’s not a savings. That’s a minor reduction on a price that’s already way too high.

Prescription assistance programs deliver the biggest savings per person. One Tennessee free clinic helped 61 patients get 23 different medications. Total savings? $222,563. That’s $3,649 per patient. No tricks. No fine print. Just free meds for those who need them most.

The Hidden Costs and Side Effects

It’s not all good news. These programs have downsides you won’t hear about on TV ads.First, manufacturer coupons can push you toward more expensive brand-name drugs-even when a cheaper generic exists. A 2024 study in JAMA found that when patients used coupons, they were 60% more likely to stick with the brand-name version. That means more money spent across the whole system. The Congressional Budget Office estimates this could add $2.7 billion a year to Medicare Part D costs.

Second, not all pharmacies honor every coupon. You might drive to three different stores before finding one that accepts your GoodRx card. Pharmacists sometimes don’t know how to process them, leading to delays and frustration. One in four users on Consumer Affairs complained about this.

Third, insurance plans can make it confusing. If you’re on Medicare Part D, you can’t use a manufacturer coupon to pay your copay unless you get special permission. And even if you use a discount card, those savings don’t count toward your deductible or catastrophic coverage. So you’re saving money now, but you might still hit that high out-of-pocket wall later.

And here’s the kicker: sometimes, using a coupon costs you more. One study found that some coupon users ended up paying higher out-of-pocket costs than if they’d just paid cash without the coupon. Why? Because the coupon reduced their copay, but their insurance still counted the full price toward their deductible. So they ended up paying more over the year.

Who Benefits the Most?

These programs aren’t for everyone. They’re most useful for:- People without insurance

- Those on high-deductible plans

- Seniors on Medicare Part D who hit the coverage gap

- Anyone paying cash for generics

If you have good insurance with low copays, you probably won’t save much. But if you’re paying full price-or your insurance says you owe $120 for a $20 generic-you’re in the right group.

Seniors are the biggest users of discount cards. About 42% of GoodRx users are on Medicare. And according to the Medicare Rights Center, 68% of them report positive experiences-especially when using the cards for generic drugs. But nearly half said they were confused about when to use the card versus their insurance. That confusion is real. And it’s expensive.

How to Use Them Without Getting Screwed

If you want to actually save money, here’s how to do it right:- Check your insurance first. Call your pharmacy and ask: “What’s my copay for this drug?”

- Then, open GoodRx or another discount app. Enter the same drug and your zip code.

- Compare the two prices. If the discount card is lower, use it. If your insurance is cheaper, stick with it.

- For brand-name drugs, check if the manufacturer has a coupon. But ask yourself: is there a generic? Is it safe to switch? Talk to your doctor.

- If you’re uninsured or low-income, apply for a PAP. Sites like NeedyMeds and RxAssist list hundreds of programs. It takes time, but it’s worth it.

- Don’t assume the coupon is always best. Sometimes, paying cash without a coupon is cheaper than using a coupon that doesn’t stack with your insurance.

Pro tip: Use the GoodRx app. It shows you prices at multiple pharmacies in real time. You can even text the coupon to yourself. It’s free. No sign-up needed. And it works for over 6,000 medications.

The Bigger Picture

The fact that we need these programs at all says something about our healthcare system. People shouldn’t have to play price-comparison games just to afford insulin or blood pressure pills. But until drug prices are fixed, these tools are lifelines.And they’re growing fast. The market for discount cards hit $18.7 billion in 2022 and is expected to hit $26.4 billion by 2025. Hospitals and clinics are adding affordability tools to their websites. Telehealth apps now integrate discount options. The system is adapting-but not fixing the root problem.

The Inflation Reduction Act is starting to change things. Starting in 2025, Medicare beneficiaries won’t pay more than $2,000 a year for prescriptions. That could reduce the need for coupons among seniors. But for the 30 million Americans without insurance? They’re still on their own.

Prescription discount programs aren’t magic. They’re a patch. A smart one, sometimes. But a patch nonetheless. Use them wisely. Know their limits. And never stop asking: why is this drug so expensive in the first place?

Do prescription discount coupons work with insurance?

Sometimes, but not always. Manufacturer coupons are often blocked by Medicare Part D and some private plans. Third-party discount cards like GoodRx don’t use insurance-they’re cash prices. You can’t combine a manufacturer coupon with insurance, but you can choose between your insurance copay and the discount card price. Always compare both before paying.

Is GoodRx better than insurance?

It depends. For generic drugs, GoodRx often beats insurance copays-sometimes by a lot. For brand-name drugs, insurance usually wins if you’ve met your deductible. Always check both. A 2023 Blue Cross Blue Shield analysis found 54% of people who abandoned prescriptions due to cost saved an average of $18.75 per script using GoodRx compared to their plan’s price.

Can I use a coupon for brand-name drugs like Lyrica?

Yes, but don’t expect big savings. One user reported saving just $1.20 on a Lyrica prescription despite using a coupon. Brand-name drugs have list prices over $1,000, and even with a coupon, you’re still paying hundreds. If a generic exists, ask your doctor if you can switch. It’s often safer and way cheaper.

Are prescription assistance programs hard to get?

It takes effort, but it’s worth it. Programs like NeedyMeds and RxAssist help you find free or low-cost meds if you’re uninsured or have low income. You’ll need proof of income, ID, and your prescription. Some require annual reapplications. But for people on $1,000-a-month drugs like Humira, it can mean the difference between taking your meds and skipping them.

Do these programs work for seniors on Medicare?

Yes, but with limits. Medicare Part D doesn’t allow manufacturer coupons, but third-party discount cards like GoodRx work fine. In fact, 42% of GoodRx users are on Medicare. Seniors save the most on generics. A 2024 study showed nearly half saved more than $5 per prescription using discount cards. But remember: those savings don’t count toward your deductible or catastrophic coverage.

What to Do Next

If you’re struggling with prescription costs, start here:- Download the GoodRx app. Compare your current copay to the cash price.

- Search NeedyMeds.org for your drug. See if a patient assistance program exists.

- Ask your pharmacist: “Is there a cheaper alternative?”

- Call your doctor. Ask if a generic or therapeutic substitute is safe.

- If you’re on Medicare, check if you qualify for Extra Help-a federal program that lowers drug costs.

There’s no one-size-fits-all fix. But if you take five minutes to compare prices and ask questions, you could save hundreds-or even thousands-over the year. That’s not just a coupon. That’s real relief.

David Brooks

December 7, 2025 AT 11:21This hit me right in the feels-I just paid $180 for my dad’s blood pressure med, and GoodRx showed it for $22 down the street. I cried in the parking lot. Not because I was happy, but because this shouldn’t be a thing in 2025. We’re not asking for free stuff, just not to be robbed by a system that pretends it’s fair.

Jennifer Anderson

December 7, 2025 AT 21:41omg yes!! i used goodrx for my metformin and saved like $50 a month?? my pharmacist looked at me like i was aliens when i showed her the barcode. she said ‘most people dont even know this exists’ and i was like… whyyyyyy?? why is this secret?? why do we have to hunt for savings like it’s a treasure map??

Sadie Nastor

December 8, 2025 AT 18:00i’ve been using NeedyMeds for my insulin for 2 years now… it’s not perfect, but it’s kept me alive. the application process is a nightmare-i had to fax 3 forms, wait 3 weeks, then get a call asking for my tax return from 2021. but when i got the meds? i cried again. not sad tears this time. just… overwhelmed. if you’re struggling, don’t give up. it’s worth the hassle. 🥲

Nicholas Heer

December 9, 2025 AT 01:04THIS IS ALL OBAMA CARE’S FAULT. THE GOVT LET BIG PHARMA OWN EVERYTHING. THEY PRINT MONEY WHILE WE STARVE. GOODRX? IT’S A DISTRACTION. THEY WANT YOU TO THINK YOU’RE ‘SAVING’ WHEN REALLY YOU’RE JUST PAYING MORE TO KEEP THE SYSTEM RUNNING. THEY’RE SELLING YOU HOPE SO YOU STOP DEMANDING REAL CHANGE. THE TRUTH? INSULIN SHOULD COST $5. PERIOD. AND SOMEONE’S GOING TO PAY FOR THIS.

Ashley Farmer

December 10, 2025 AT 21:20Thank you for writing this with so much care. I’ve been a pharmacy tech for 12 years, and I see people choosing between meds and groceries every single day. The system isn’t broken-it was designed this way. But knowing how to use GoodRx or PAPs? That’s power. You’re not just saving money-you’re giving people dignity. Keep sharing this.

Kurt Russell

December 12, 2025 AT 17:57Here’s the pro tip they don’t tell you: always call the pharmacy FIRST. Don’t trust the app. One time I saw a $12 price on GoodRx, drove 20 minutes, and they said ‘we don’t honor that card.’ Turned out the pharmacy had a system glitch. The real trick? Ask the pharmacist: ‘What’s the lowest price you can give me today?’ They sometimes have unlisted discounts. You’d be shocked how often they’ll drop it another $10 just to keep you coming back.

Oliver Damon

December 13, 2025 AT 16:28The real tragedy isn’t the price tags-it’s the normalization of suffering. We’ve turned pharmaceutical access into a personal finance puzzle instead of a human right. The fact that we need third-party discount cards to survive is a moral indictment. And yet, we praise the people who figure out the system instead of demanding it be fixed. We’re not clever for hacking a broken machine-we’re surviving it. And that’s not a win. It’s a warning.

Sangram Lavte

December 13, 2025 AT 19:54