A drug formulary is a list of prescription medications that your health insurance plan agrees to cover. It’s not just a catalog-it’s a tool that decides which drugs you can get at a low cost, which ones will cost you more, and which ones your plan won’t cover at all. If you’ve ever been surprised by a high copay or denied coverage for a medication, it’s likely because of your plan’s formulary.

How a Drug Formulary Works

Your insurance company doesn’t cover every drug on the market. Instead, they work with Pharmacy Benefit Managers (PBMs) to build a list of preferred medications. These lists are updated regularly based on clinical evidence, cost, and safety. The goal? To give you access to effective treatments while keeping overall healthcare spending under control.

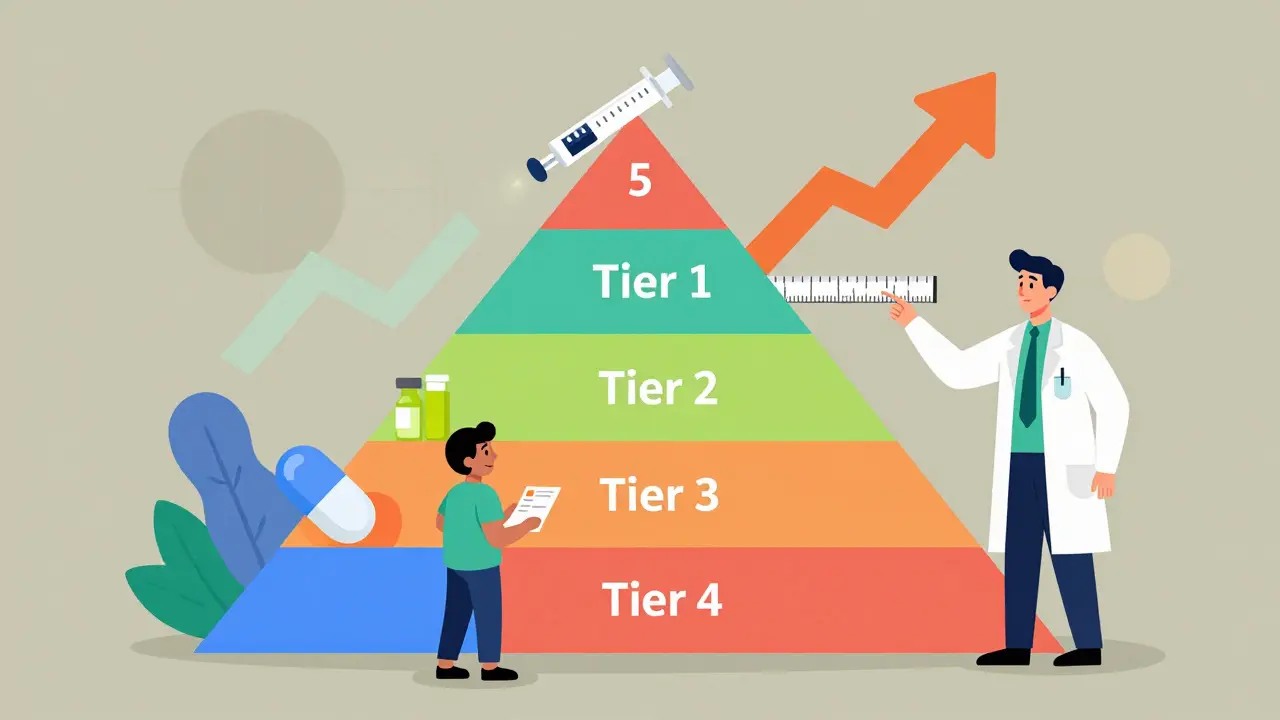

Most formularies are divided into tiers. Each tier has a different cost for you, the patient. The lower the tier, the less you pay. Here’s how it typically breaks down:

- Tier 1: Generic drugs - These are the cheapest. They’re exact copies of brand-name drugs, approved by the FDA to work the same way. You’ll usually pay $0-$10 for a 30-day supply.

- Tier 2: Preferred brand-name drugs - These are brand-name medications your plan has negotiated lower prices for. Expect to pay $25-$50 per prescription.

- Tier 3: Non-preferred brand-name drugs - These are brand-name drugs your plan doesn’t promote. You’ll pay more-often $50-$100 per fill.

- Tier 4: Specialty drugs - Used for complex conditions like cancer, MS, or rheumatoid arthritis. These can cost $100-$500 per month, or you might pay 30-50% of the total price as coinsurance.

- Tier 5 (if present): Highest-cost specialty drugs - Some plans have this tier for the most expensive treatments, like gene therapies or rare disease medications.

These tiers aren’t random. They’re decided by a Pharmacy and Therapeutics (P&T) committee made up of doctors, pharmacists, and other experts. They meet every few months to review new drugs, safety reports, and real-world outcomes before adding or removing medications.

Why Formularies Change-And What It Means for You

Formularies aren’t set in stone. They change throughout the year. A drug you’ve been taking for years could suddenly move from Tier 2 to Tier 3. That means your monthly cost could jump from $35 to $85 overnight. In 2023, nearly 30% of patients reported a change in their medication’s tier or coverage status.

Why does this happen? Often, it’s because:

- A generic version of your drug became available.

- The manufacturer lowered its price, making the drug more attractive to your plan.

- A new, more effective drug entered the market and replaced yours.

- Your plan renegotiated its contract with the drugmaker.

These changes are legal-but they’re not always communicated clearly. That’s why you can’t assume your medication will stay covered the same way year after year.

What If Your Drug Isn’t on the List?

If your doctor prescribes a medication that’s not on your formulary, you’re looking at one of two things: either you pay full price (which could be hundreds or even thousands of dollars), or you ask for an exception.

A formulary exception is a formal request for your plan to cover a drug that’s not on the list. Your doctor must submit clinical documentation showing why the drug is medically necessary-for example, if you had bad side effects from all other options or if the drug is the only one proven to work for your condition.

According to Medicare data from 2023, about 67% of exception requests were approved. Expedited requests-used in urgent cases like cancer treatment or severe pain-can be processed in as little as 24 hours.

Don’t give up if your request is denied. You can appeal. Many patients win their appeals with the help of their doctor’s notes or patient advocacy groups.

Formularies Vary-Even Between Similar Plans

Not all insurance plans are the same. Two Medicare Part D plans might cover the same drug, but one puts it on Tier 2 and the other on Tier 4. That means one patient pays $30 a month, and the other pays $120.

A 2022 Kaiser Family Foundation study found that the same diabetes medication could cost anywhere from $15 to $150 per month depending on the plan. This isn’t a glitch-it’s how the system works.

Here’s why:

- Some plans use numbers for tiers; others use names like "Preferred Generic" or "Specialty Tier."

- One plan might require step therapy (trying cheaper drugs first); another might not.

- Some plans limit how much of a drug you can get each month.

- Prior authorization rules differ-some require a phone call, others need paperwork.

This is why comparing formularies during open enrollment isn’t just smart-it’s essential.

How to Check Your Formulary

You can’t rely on your pharmacist or doctor to know every detail of your plan’s formulary. You need to check it yourself.

Here’s how:

- Log in to your insurance plan’s website. Look for a link labeled "Formulary," "Drug List," or "Prescription Benefits."

- Search for your medication by brand or generic name.

- Check the tier, any restrictions (like prior authorization), and your estimated cost.

- Do this every year during open enrollment (October 15 to December 7 for Medicare plans).

Medicare beneficiaries can use the Medicare Plan Finder tool to compare formularies across all Part D plans in their area. It’s free, updated annually, and shows you exactly what each plan covers.

Pro tip: Even if your drug is listed, check if there are quantity limits. Some plans only cover 15 pills instead of 30, forcing you to pay out of pocket for the rest.

Real Patient Stories

People’s experiences with formularies vary widely.

One patient, "MedicareMom2023," shared on Reddit: "My diabetes drug moved from Tier 2 to Tier 3. My copay jumped from $35 to $85. I had to switch-no choice. I couldn’t afford it."

Another, "CancerSurvivor87," wrote on a patient forum: "My immunotherapy was on Tier 4. My copay was $95. Without the formulary, I’d have paid $5,000. It saved my life."

According to a 2023 Kaiser survey, 68% of insured adults check their formulary before filling a prescription. Over 40% have switched medications because of formulary changes.

What’s New in 2024-2025

Big changes are happening:

- Insulin cap: Since 2023, Medicare Part D plans must cap insulin at $35 per month. This applies to all patients, regardless of income.

- Out-of-pocket cap: Starting in 2025, Medicare beneficiaries will have a $2,000 annual cap on total drug costs.

- Biosimilars: More generic versions of expensive biologic drugs are hitting the market. These are cheaper alternatives to drugs like Humira or Enbrel. Formularies are starting to favor them.

- AI-driven formularies: By 2027, some plans will use AI to recommend medications based on your health history, not just cost.

- Clearer exceptions: CMS is requiring standardized forms for formulary exceptions by 2025, making appeals easier to file.

What You Can Do Now

You don’t have to be confused by your formulary. Here’s what to do:

- Always check your formulary before your prescription is filled.

- Ask your pharmacist: "Is this on my plan’s formulary? What tier? Any restrictions?"

- If your drug is expensive or not covered, ask your doctor about alternatives on your plan’s list.

- Request a formulary exception if your medication is medically necessary and not covered.

- Review your plan every year during open enrollment-even if you’re happy with it.

Formularies are designed to save money-but they only work if you understand them. Don’t wait until you’re at the pharmacy counter to find out your drug isn’t covered. Stay ahead. Ask questions. Know your options.

What is a drug formulary?

A drug formulary is a list of prescription medications that your health insurance plan covers, organized into tiers based on cost. It determines which drugs you can get at a lower price and which ones may require extra steps or cost more out of pocket.

Why does my insurance not cover my medication?

Your medication may not be on your plan’s formulary, meaning the insurer didn’t include it because of cost, availability of alternatives, or lack of clinical preference. It could also be subject to restrictions like prior authorization or step therapy.

How do I find out if my drug is on the formulary?

Log in to your insurance plan’s website and search for "formulary" or "drug list." You can also call customer service or ask your pharmacist. Medicare beneficiaries can use the Medicare Plan Finder tool.

Can I get a drug that’s not on the formulary?

Yes, but you’ll likely pay full price unless you request a formulary exception. Your doctor must submit documentation proving medical necessity. Approval rates are around 67% for Medicare Part D plans.

Do formularies change every year?

Yes. Formularies are updated annually, usually on January 1. But changes can happen mid-year too, with 60 days’ notice required by law. Always check your formulary before filling a prescription.

What’s the difference between generic and brand-name drugs on a formulary?

Generics are chemically identical to brand-name drugs and are almost always in Tier 1, costing $0-$10. Brand-name drugs are in higher tiers and cost more. Insurance plans prefer generics because they save money without sacrificing effectiveness.

Are there limits on how much of a drug I can get?

Yes. Many plans limit the quantity you can get at one time-for example, 30 pills instead of 90. This is called a quantity limit. If you need more, your doctor can request an exception.

What is step therapy?

Step therapy means your plan requires you to try one or more lower-cost drugs before approving a more expensive one. For example, you might have to try two generic pain relievers before your insurer covers a stronger prescription.

Next Steps for Patients

If you’re on a chronic medication, write down your drug name, tier, and monthly cost. Do this now. Then, check your formulary again in October, before open enrollment. If you’re switching plans, compare the formularies side by side. Don’t just look at premiums-look at what’s covered and how much you’ll pay for your prescriptions.

Remember: Your doctor prescribes based on your health. Your formulary decides what you can afford. Stay informed, speak up, and don’t accept surprises at the pharmacy.

Victoria Rogers

December 16, 2025 AT 03:01So let me get this straight - the government lets private companies decide what meds I can afford? And if I need something that’s not on their little list, I’m screwed? Wow. Just wow. This isn’t healthcare, it’s a casino where the house always wins. And don’t even get me started on how they push generics like they’re magic pills. My aunt took a generic for her BP and ended up in the ER. But hey, it saved the insurer $3 a month. Perfect trade-off, right?

Jane Wei

December 17, 2025 AT 06:11just checked my formulary today lol. my anxiety med went from tier 1 to tier 3. $12 to $78. no warning. no email. just a surprise bill at the pharmacy. i’m switching plans next year. no cap, no mercy. 😑

Nishant Desae

December 19, 2025 AT 04:13Hi everyone, I just want to say that I’ve been working in healthcare for over 15 years in India, and I’ve seen how formularies work differently across countries. In the U.S., it’s very much about cost control, but in places like ours, sometimes the formulary is more about availability than cost - because many drugs simply aren’t imported at all. I know it’s frustrating when your medication gets moved to a higher tier, but please don’t lose hope. Talk to your pharmacist, ask for samples, and if you’re eligible, reach out to patient assistance programs. There are people who want to help - you just have to ask. And yes, check your formulary every year. I promise, it saves heartache later. 🙏

Martin Spedding

December 19, 2025 AT 06:03Typical. Insurance companies play monopoly with people’s lives. And the ‘P&T committee’? More like ‘Profit & Theft’ committee. Also, ‘specialty drugs’? More like ‘rip-off tier 4.’

Chris Van Horn

December 19, 2025 AT 07:31It is patently absurd that the average American citizen is expected to navigate an opaque, corporate-driven, tiered pharmaceutical hierarchy - one that is deliberately engineered to obscure cost structures and incentivize non-compliance through financial coercion. The fact that you must proactively audit your own formulary, rather than being provided with a transparent, legally mandated disclosure, constitutes a fundamental breach of fiduciary duty by the entire PBM-industrial complex. This is not a healthcare system. It is a predatory market architecture masquerading as social infrastructure.

Virginia Seitz

December 20, 2025 AT 10:06My insulin costs $35 now 😭 thank u 2023 law! But my migraine med? $120. Sooo unfair. 🤦♀️ #formularyhell

Sachin Bhorde

December 21, 2025 AT 07:59Y’all need to understand that tiering is based on pharmacoeconomic modeling - PBMs use ICERs (incremental cost-effectiveness ratios) to prioritize drugs with the best QALYs per dollar. Generic substitution is not just about cost - it’s about population-level outcomes. That said, the lack of transparency in prior auth requirements and step therapy protocols is a systemic failure. If you’re on biologics, always check for biosimilar alternatives - they’re 15–30% cheaper and clinically equivalent. Also, don’t forget to ask your doc for a 90-day supply waiver - it reduces your coinsurance burden and cuts down on refill hassle. Pro tip: Use GoodRx alongside your insurance - sometimes the cash price beats your tier 4 copay.

Kent Peterson

December 23, 2025 AT 00:50Wow. Just... wow. Another article that treats patients like idiots who need to be told how to use Google. Of course you check your formulary. Of course you compare plans. Of course you ask for exceptions. This isn’t rocket science. It’s basic adulting. If you can’t manage your own healthcare logistics, maybe you shouldn’t be on a plan that requires you to be a part-time pharmacist, insurance broker, and legal advocate. Also - the 2025 $2,000 cap? That’s a band-aid on a hemorrhage. PBMs still skim 15% off every prescription. And don’t get me started on how they force you into step therapy just to make you suffer long enough to give up. This system is broken. Not because you’re uninformed - because it’s designed to break you.